Anders Petterson is the managing director of ArtTactic Ltd., a London-based art market research and advisory company he set up in 2001. Petterson is a leading authority on the art market, with a particular focus on the modern and contemporary emerging art markets.

Prior to founding ArtTactic, Petterson worked in investment banking at JP Morgan, where he was responsible for the debt capital market and structured products for banks and corporates. He worked as an independent research and evaluation consultant for Arts & Business in London between 2002 and 2007, and has been involved in a number of large research and evaluation projects in the cultural sector.

Petterson also lectures on the topic of ‘Art as an Asset Class’ for CASS Business School and Sotheby’s Institute in London.

A discussion with art market analyst Anders Petterson on the business of art. Bhavna Kakar and Shivani Chandra caught up with Petterson on email and phone to discuss his impressions of the South Asia art scene, what happened to the Indian art market in 2009, and what it will take for Indian investors to become more savvy collectors of art.

Bhavna Kakar and Shivani Chandra (BK & SC): You have covered the Indian art market for the last nine years. This has no doubt given you an in-depth and varied perspective on the trajectory of the art market. As an insider, could you share with us some of the most remarkable shifts you have witnessed? What kind of narrative have you seen unfold?

Anders Petterson (AP): The Indian art market went through a boom during 2005 – 2008, similar to several other emerging art markets such as China, Southeast Asia and the Middle East. This particular cycle saw an influx of new art buyers with a strong focus on art as an investment, which led to speculation and an unsustainable increase in prices, particularly for contemporary Indian art. However, despite the subsequent downturn in the market between 2009 – 2013, the boom years left the Indian art market with improved and more diverse infrastructure, such as an international art fair (India Art Fair) and an art biennial (Kochi-Muziris Biennale), more private museums (among these Devi Art Foundation, Kiran Nadar Museum of Art), international museum exhibitions of Modern Indian art (Gaitonde @Guggenheim, Husain @V&A) as well as a gallery sector that has demonstrated the ability to survive and thrive despite the downturn.

I believe the Indian art market has entered its 2nd art market cycle, which I hope will be a gradual and more sustainable boom than its predecessor. However, the speed of a market boom is always hard to control as rapidly rising prices often draw in new and less experienced art buyers. Through more education and increased knowledge and understanding of art and the art market – we might be able to partially mitigate or at least manage risks associated with buying and investing in art.

BK & SC: Looking at the latest confidence figures, it appears the Indian art market has fully recovered from the 2009 economic crisis. Is that a fair conclusion to make, and where do you think the market will go from here?

AP: Although the ArtTactic Indian Art Market Confidence levels are now just below the levels in October 2007, I believe we are talking about a different type of confidence today. The confidence in the market in 2007-2008 was predominantly based on the strong auction market, now the market is more nuanced, and the current confidence is based on stability and an increase in auction prices for high-quality, rare works by modern Indian artists. Also, art market institutions such as the India Art Fair, Kochi-Muziris Biennale and Kiran Nader Museum exposure of Indian art have brought renewed energy back into the Indian art market.

According to our last confidence survey in December 2014, 49% of the experts believe the modern Indian market will go up in the next 6 months (51% believe the market will remain flat) and 40% of the experts believe the contemporary Indian market will have a positive trend in the first half of 2015 (44% believe the market will remain flat).

BK & SC: Why has the high end of the Indian contemporary art market lagged? What’s preventing investors from having confidence in that market? Any chance for growth?

AP: On the back of speculation, prices at the high end of the Indian contemporary art market shot up too quickly during the boom years. The auction prices simply didn’t reflect the ‘cultural value’ of these artists, particularly in a global art market, and many became overvalued compared to their international peers.

Confidence in the high end of the Indian contemporary art market remains low. I believe the strong performance of the high end of the modern Indian art market will eventually start to trickle down to the contemporary art market, although I think this will take some time. The contemporary art market needs to see a strong new generation of Indian contemporary talents emerging before confidence returns to the previous generation of Indian contemporary artists.

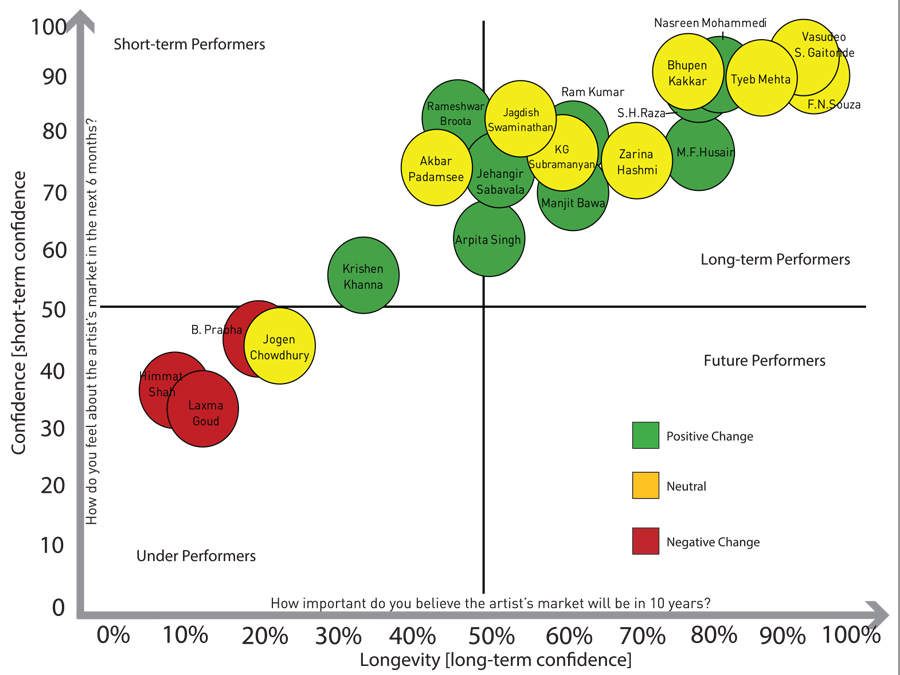

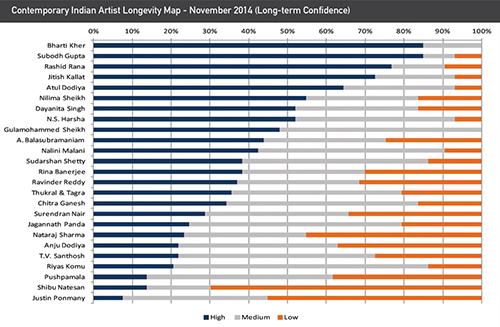

BK & SC: Which particular artists in India’s contemporary and modern segments do you think are particularly worth watching out for?

AP: Based on ArtTactic’s research and market surveys from December, 2014 the highest long-term confidence is in the following artists: Top 10 Modern Artists: F N Souza, V S Gaitonde, Tyeb Mehta, Nasreen Mohammedi, M F Husain, S H Raza, Bhupen Khakhar, Zarina Hashmi, Manjit Bawa and Ram Kumar Top 10 Contemporary Artists: Bharti Kher, Subodh Gupta, Rashid Rana, Jitish Kallat, Atul Dodiya, Nilima Sheikh, Dayanita Singh, N S Harsha, Gulammohammed Sheikh and A Balasubramaniam.

BK & SC: What specific factors drive investor confidence in a particular artist? And how do those factors differ in the short and long term?

AP: This would vary a lot from artist to artist and from market to market. However, in the short term, confidence is typically driven by auction performance (if the art is being sold in the secondary market) as well as news about collector and museum acquisitions, together with exhibitions and critical reviews.

Long-term confidence is more linked to whether the market believes the artists are good enough to stand the test of time and have the right support structure (commercial and institutional) to survive the ups and downs in the market.

BK & SC: Relative to the Asia art market as a whole, what are India’s strengths

and what can it improve upon from an investment perspective?

AP: India still lacks investment in both private/public art infrastructure (more galleries, museums, and collectors), particularly compared to neighbouring China. On the other hand, India has great potential. It is among the largest economies in the world, with one of the fastest-growing HNWI populations. However, the mentality towards art investment needs to change to become a long-term endeavour, otherwise, we could find ourselves back to 2009.

BK & SC: Would a more mature auction structure help build higher confidence

in the Indian art market? What impact would it have on pricing?

AP: I think the auction market has been one of the main problems for the Indian art market as it has been the only barometer for success in the Indian art market. So I don’t think it is about a more mature auction market, but a more mature and balanced art ecosystem, where auction houses are only one of the key players.

BK & SC: India is known as a country with an investment mentality – whether it be gold, jewellery, or real estate. This mentality permeates the art market as well. Please comment.

AP: It did, but people got severely burnt in 2009, when they realized that art was a very illiquid investment. It has taken a long time for speculators to return, which is probably a good thing, as it has allowed the Indian art market to clean up after the boom years. With the experience of the downturn, hopefully more informed investors will enter the market going forward.

BK & SC: Why does investment in art supersede philanthropy or buying art for art’s sake in India? Any reason why we Indians have not been able to build a collecting culture? The wealthy in India are willing to spend on the latest Limited edition Bottega or luxury weddings worth millions but when it comes to art investment it is not a top priority!

AP: I would say that there are relatively few art buyers in the world today that are ONLY buying art for art’s sake (emotional value), most motivations for buying art would be a mix between the emotional, social and financial. Most new, wealthy art buyers, in India and elsewhere, will initially be driven by the financial (investment potential) and the status (conspicuous consumption and glamour) that the art market and art world provides. Building an “art collecting culture” or a stronger emotional engagement with art requires investment in education, a stronger focus on connoisseurship and knowledge about the art and its history, and finally an infrastructure to support this – ingredients which in my opinion are still lacking in India.

BK & SC: Are India’s art collectors buying significantly in the international market, or is their investment mostly confined to the domestic market?

AP: Purely based on my own experience, I would say that the majority are still focusing on the domestic art market.

Images courtesy (except where mentioned): ArtTactic